QuickBooks allows you to enter expenses directly to your Chart of Accounts through journal entries or bills, checks and expenses. In order for your budget actuals to come into CoConstruct however, expenses must be entered using your Item List (QuickBooks Desktop) or Products & Services (QuickBooks Online). This is because your CoConstruct accounting codes are linked to these items and products/services.

Why is the CoConstruct integration setup to link this way?

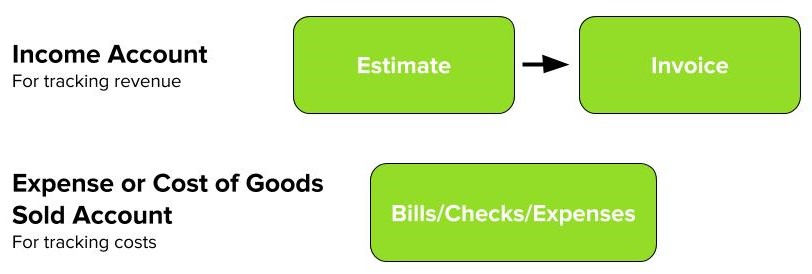

Your Chart of Accounts in QuickBooks is going to have completely separate accounts for tracking your expenses and costs of goods sold than your revenue or income. These accounts are not linked in any way and different transactions in QuickBooks require different types of accounts depending on whether it’s a transaction accounting for your costs or revenue.

This setup is great for reviewing your overall company financials to ensure your business is profitable and to prepare your taxes and end of the year financial statements.

It isn’t as helpful for job costing where you want to be able to tell that what you charged your client for framing actually covered your framing costs and brought in a profit.

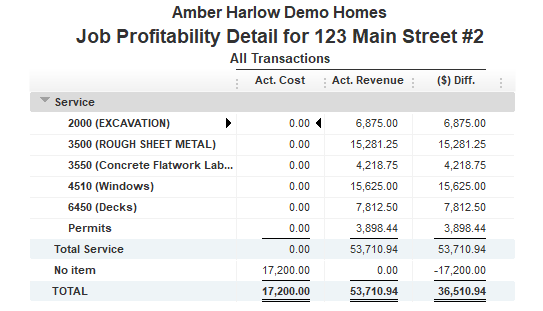

QuickBooks doesn’t allow you to build your client’s estimate or invoice using expenses accounts. So if CoConstruct pushes your estimate using items (which is then used to create your client’s invoice) and your expenses are recorded directly to expense accounts, your Job Profitability report may look similar to this:

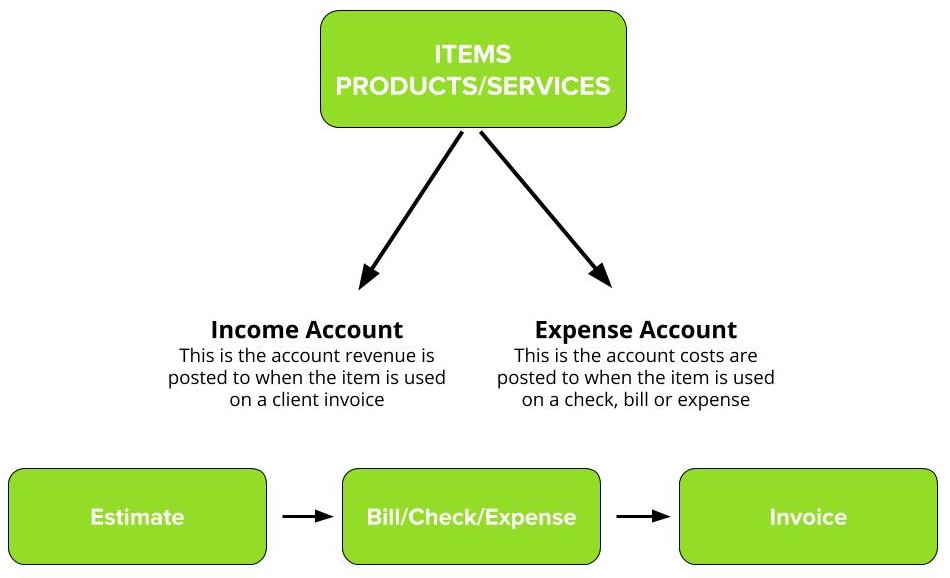

On the other hand, when you set up your Item List (QuickBooks Desktop) or Products & Services (QuickBooks Online), each item can be linked to both an income account for tracking revenue AND an expense or COGS account for tracking costs.

This allows you to use the same item on all job related transactions.

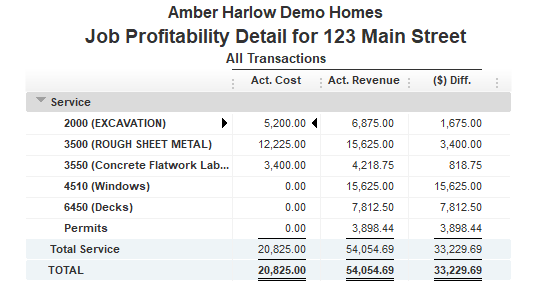

In turn, you are able to track job profitability by item to better identify which areas of the project cut into your profit or where you were able to perform under budget.

This allows CoConstruct to utilize a single list of accounting codes that can be used for estimates, time tracking, invoices AND bills that are pushed to QuickBooks and produce similarly effective estimate vs. actuals reports for your projects.