Need to separate out provincial, city, or state taxes on your proposal? Follow the easy steps below to ensure you line item any taxes on proposals.

CONFIGURE YOUR TAX

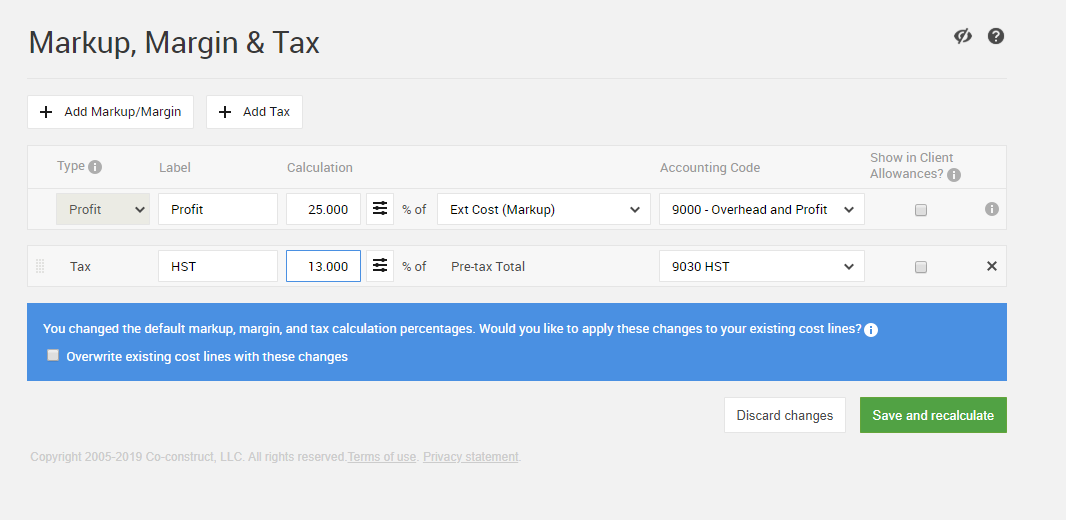

If you live in an area that requires you to apply a tax to the entire price of a construction project, you'll need to first make sure you've accounted for this tax on your project. Start on the project in question then navigate to the Estimate. Click on "% Markup, Margin & Tax" at the top of the estimate page.

Use the + Tax button to set up any taxes you need calculated to the pre-tax total of the project. Input the percent you'd like CoConstruct to calculate and set the appropriate accounting code. Select to Overwrite existing cost lines with these changes in the blue banner that appears to allow the tax percent to go into effect on your current estimate.

Save and recalculate to submit your changes!

SHOW TAX SEPARATELY

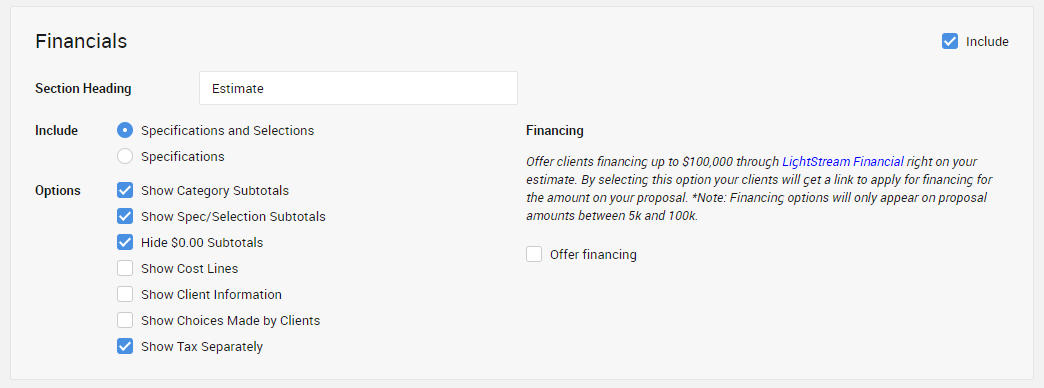

Once you've started a Proposal document, you'll see an option for the Financials section to Show Tax Separately.

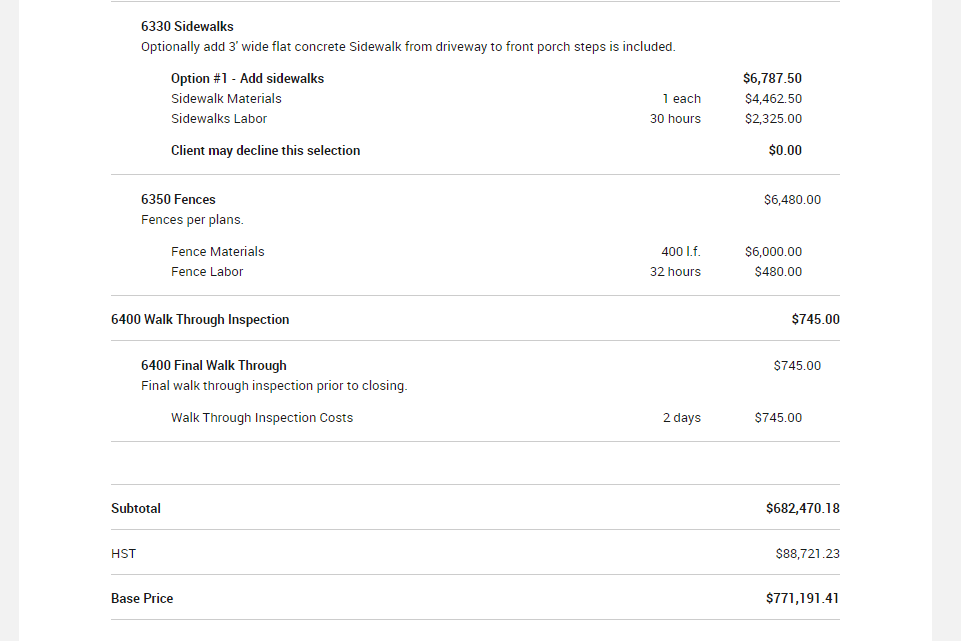

This will allow any taxes set up on the project to receive their own distinct line on the proposal.

Simply Save & Preview then Send for Approval to get your proposal in front of a client and signed!

Note: This enhanced proposal function is only available on CoConstruct Core, Standard, and Plus plans.